Description

The Introduction to Financial Mathematics Content Pack is a Möbius course developed by the University of Waterloo that you can use as a customizable starting point to a complete financial mathematics course in Möbius. This Content Pack is designed for first-year non-STEM students that focuses on algebraic applications in finance. This Content Pack explores: interest rates, annuities, and investment. This customizable resource contains 6 units of sectioned lessons and assignments enhanced with Möbius capabilities including algorithmic questions, in-lesson questions with unlimited practice, adaptive questions, interactive narratives, Math Apps, immediate feedback, and end-of-section assignments.

How does Möbius take the University of Waterloo’s content to the next level?

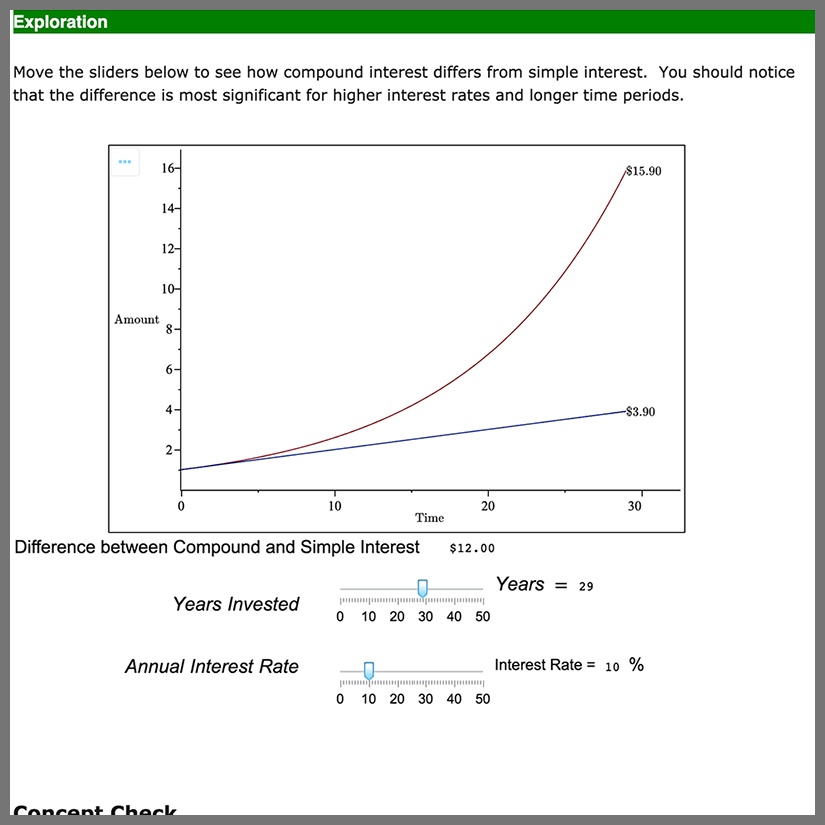

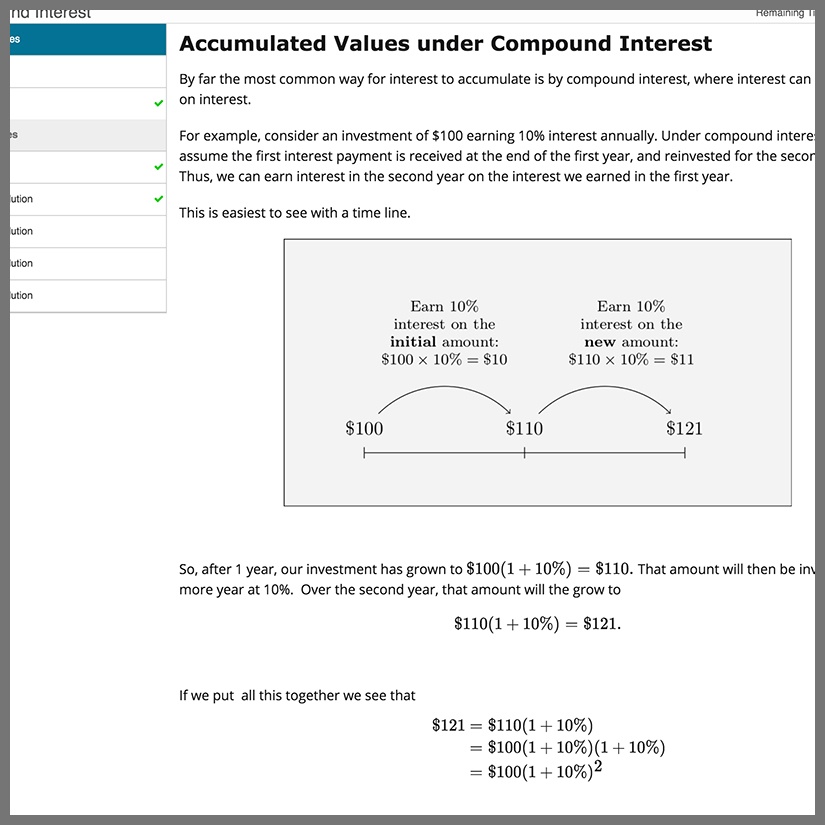

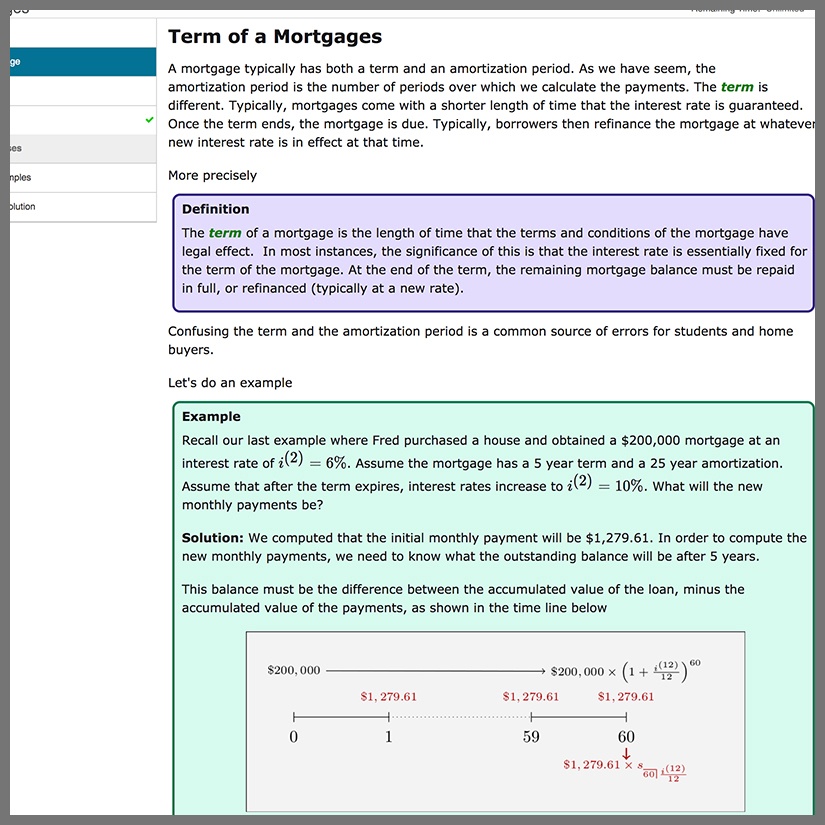

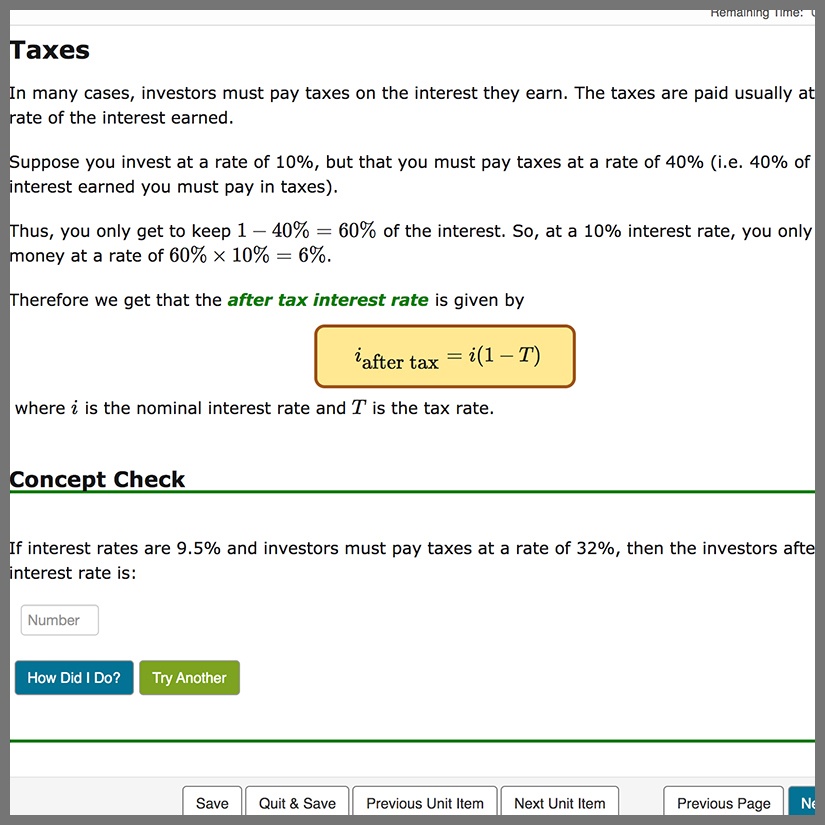

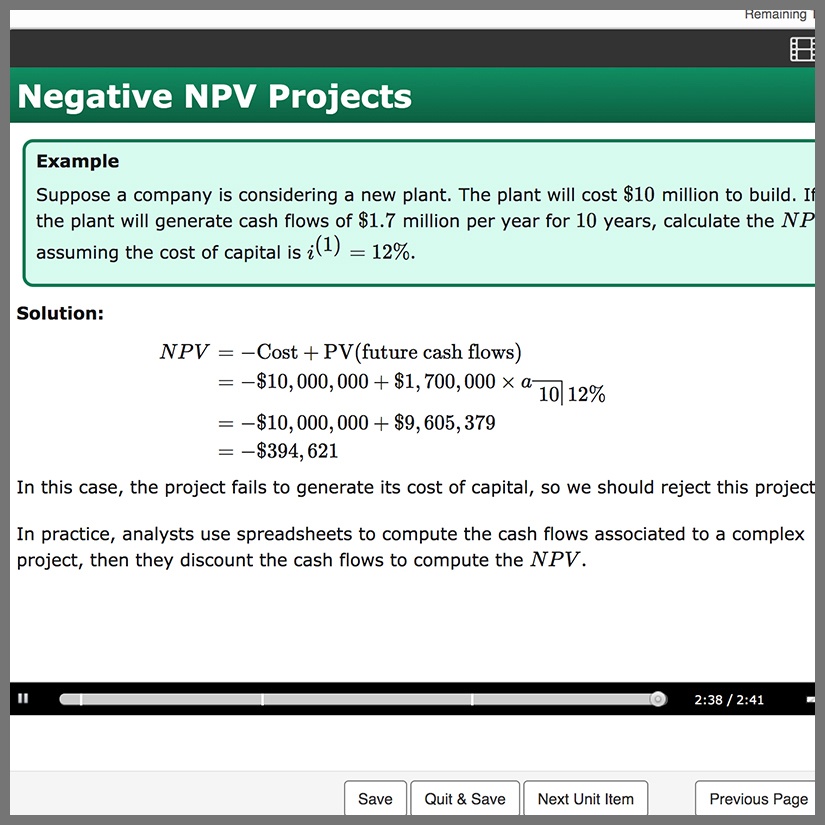

Lessons contain interactive elements like Interactive Narratives, HTML objects, Math Apps, or Geogebra applications to help solidify difficult STEM concepts.

Learn how Möbius’ unique STEM question types throughout this content provide the best STEM learning experience.

Work with over 50 configurable assessment properties when modifying existing or building your own assessments.